Almost everyone carries some amount of debt at some point in their life, whether it be student loan debt, credit cards, a car loan, or a mortgage. I know I sure do. Debt typically can be either “good” or bad. Good debt is generally debt that goes toward something that is a major investment that will pay off one day. For example, a mortgage is typically considered a type of “good” debt. Credit cards and payday advance loans are usually considered bad debt.

Below I’ve listed 6 steps for paying off your debts quickly.

1. Understanding debt

Financial gurus have all sorts of different philosophies on debt, ranging from juggling multiple credit cards to never carrying debt, in any case. Personally, I fall somewhere in the middle of the spectrum, leaning a little closer to having as little as possible.

I firmly believe that debt is a tool that can be leveraged for a purpose, as long as it is used responsibly. Some things are very difficult to get without debt of some sort, most notably a house. Most other things, however, can and should be paid for with cash (with maybe the exception of a car).

I have been subject to debt in my early days of personal finance, and I know from experience that it is very easy to get buried under mountains of it. In order to avoid this, it’s critically important to develop a mindset of not being reliant on debt. This is followed by one simple rule: If you can’t buy it cash, don’t go into debt for it.

This can be very hard to do, and takes a lot of discipline. It’s so easy to simply swipe your card, and worry about it later. You have to avoid this thinking at all costs.

Most things can be bought without borrowing money, and those that can’t be, really shouldn’t be bought. Think about it, why would you go into debt, and pay interest, for an item that you can’t afford? It’s so much better to take your time and save up for that item. Also, it’s much more fulfilling when you finally do save enough saved up to buy that thing you’ve been waiting for.

2. Debt vs. budgeting

So let’s say you’ve made the mistake of going into debt for something (let’s exclude emergencies, such as unexpected medical bills, or large-ticket items such as a mortgage). It can feel overwhelming to look at that balance of how much you owe. How are you going to pay it off? The answer is simple: You plan for it. This is where a budget comes into play.

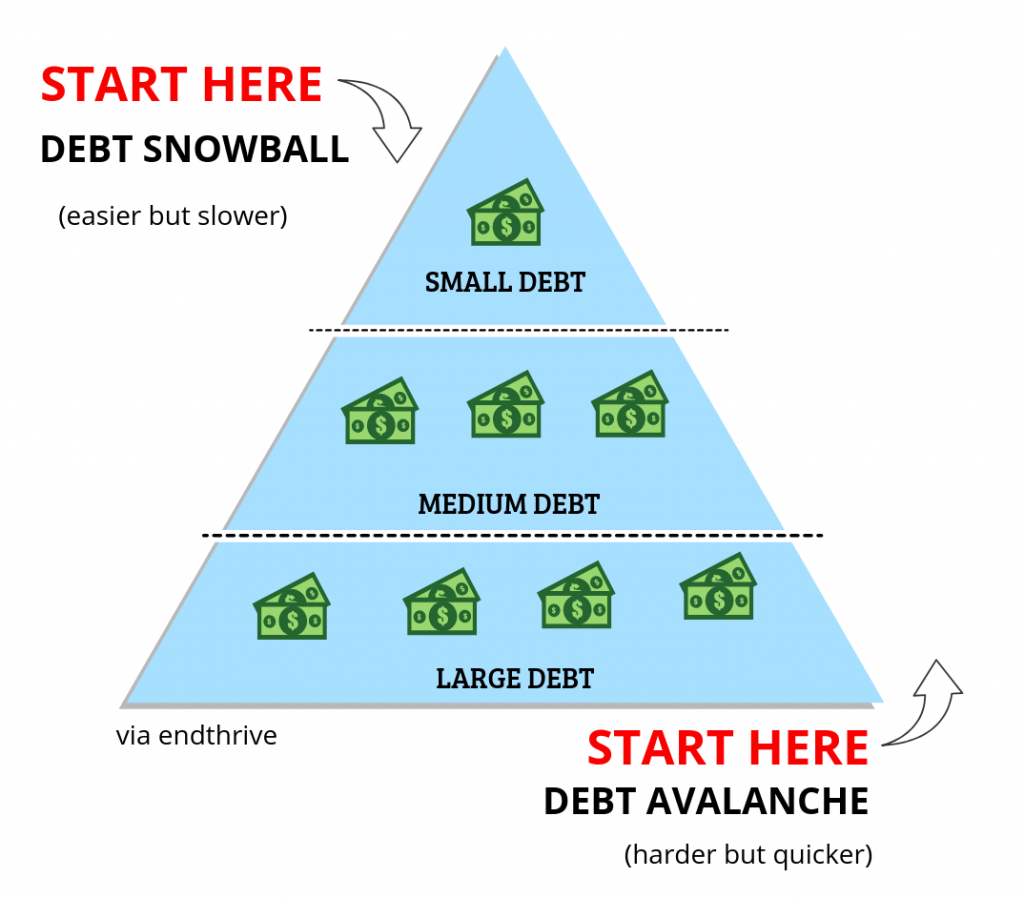

Once you’ve set up a budget that works for you, and you have taken care of all of your expenses (including paying yourself first), you can then start allocating money towards debt that you owe. There are two widely accepted methods of paying down debt: the snowball method and the avalanche method.

Don’t be this guy.

3. The Snowball Method

The first of the two debt payoff methods is the Snowball method. This basically means to pay off your debts in order of lowest balance first, regardless of interest rate. This means to pay the minimum amount due on all loans, except for the lowest balance one.

On this one, take as much money as you can spare and apply all of it to the principal. After you knock that loan out, take the money that you were applying to this loan and apply it to the next largest loan. Continue this until all of the loans are paid off.

The snowball method does 2 things. Firstly, it’s good for giving yourself a psychological boost, since seeing debts getting paid off will empower you and encourage you to keep going. Secondly, when you do pay off a loan quickly, you free up cashflow, because you no longer have to pay that minimum payment for that loan each month.

The only downside to the snowball method is that since it disregards interest rate, you will collect more interest on loans with higher rates over the life of that loan. In short, the longer you have a loan open with a higher interest rate, the more you pay in the long run.

4. The Avalanche Method

The second debt payoff strategy is the Avalanche method. With this method, you pay off your debts in order of highest interest rate first, regardless of balance. This method will save you the most money in the long run.

The only downside to the avalanche method is that it can get discouraging, particularly if you have a loan with a large balance and a high interest rate. It can feel like you’re not even making a dent.

5. The Hybrid Method

So which do I recommend? I personally prefer to do what I call the Hybrid method. What I do is start with the loans with the highest interest, but lowest balance. So let’s say I had 4 loans:

$4,000 @7.5%,

$2,000 @9%,

$3,000 @9%, and

$1,000 @ 6%.

I would pay the $2k loan first, followed by the $3k loan, then the $4k loan, then finally the $1k loan.

This method has the dual benefit of keeping that psychological momentum going, while saving you some money in the long run. I really recommend this method, but try all 3 (or any combination) to see which one works best for you.